.png)

.png)

.png)

.png)

A general ledger is the heart of an accounting department. Without it, accountants can’t create reports that accurately reflect their company’s financial health and performance. As accounting needs become more complex and demand higher technical expertise, maintaining a general ledger is as critical as any other accounting task.

In the past, general ledger accounting involved manual (and tedious) documentation. But those days are long gone, and it’s high time for companies to innovate their general ledger accounting operations without sacrificing productivity and compliance.

In this case, outsourcing general ledger accounting is a game-changing idea, as it enables business scalability, cost savings, operational efficiency, and even DEI-driven efforts. If you’re thinking of outsourcing this function, we’ve done the legwork of rounding up the best general ledger accounting firms for US companies. Take a look at our list of the best credit control agencies in the Philippines, too!

A general ledger is a system that houses the financial transactions of all accounts — namely, assets, liabilities, equity, revenue, and expenses — aiding both financial management and report preparation. Through a general ledger, accountants and bookkeepers can monitor all transactions and cash flow, assess the company’s financial health, and maintain compliance.

The way a general ledger works is straightforward. Transactions are recorded in a journal entry, each one containing pertinent details such as the date and amount. After the entries have been organized into the appropriate account type, they are then posted and consolidated into the general ledger’s accounts.

Next, the general ledger prepares a trial balance and ensures the tallying of all credit and debit transactions. During the accounting reconciliation process, account recording errors, outstanding balances, missing transactions, and other discrepancies are identified and investigated.

Finally — once the discrepancies are addressed and the entries are adjusted — accounting professionals can use the information in the general ledger to prepare financial statements.

We understand the hurdle of finding the right general ledger accounting firm for your needs. Below, we rounded up the best companies that offer general ledger accounting services (and other accounting functions) to US companies.

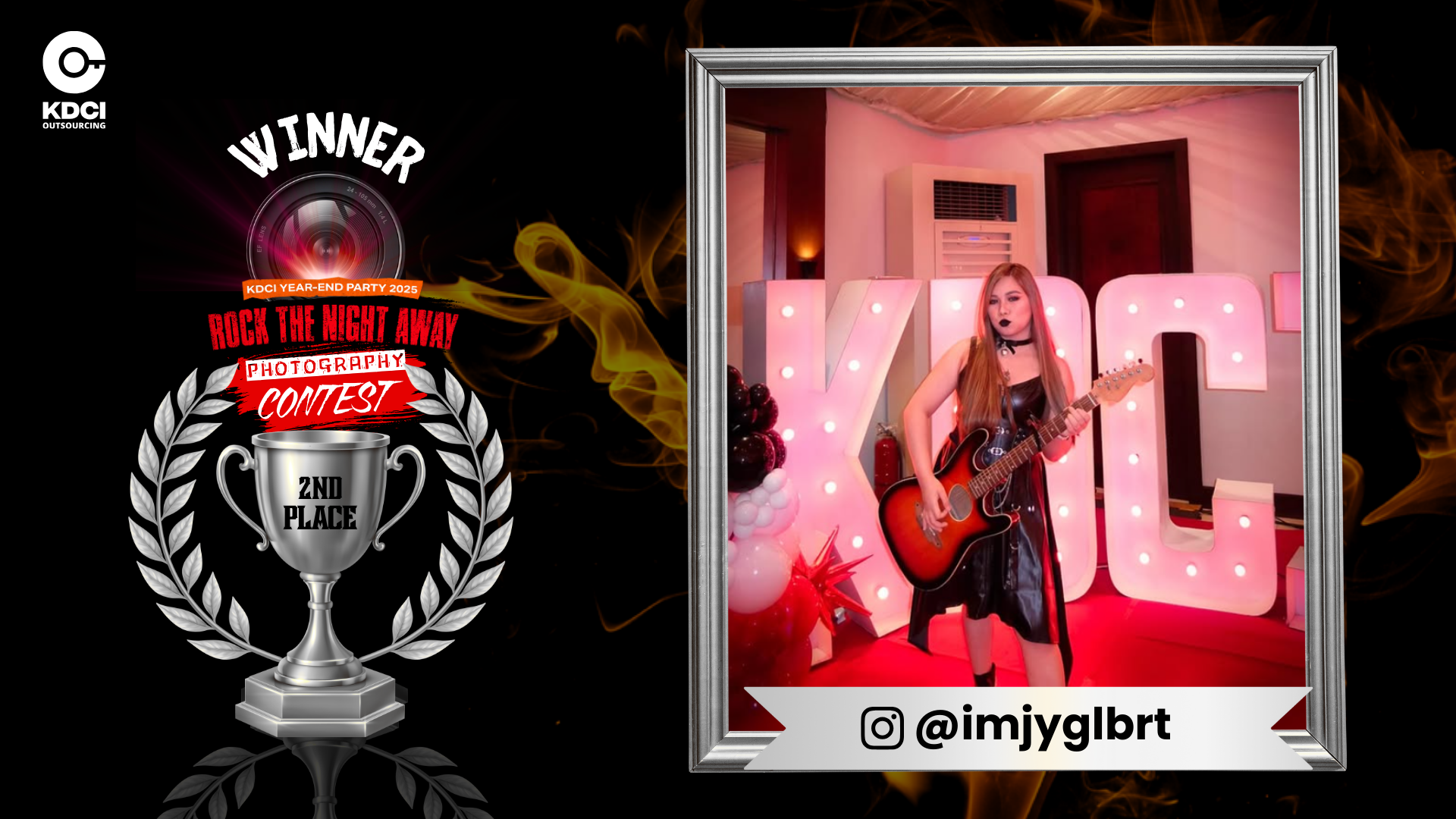

Headquartered in Pasig City, Philippines, KDCI Outsourcing is a BPO company with an outstanding track record of providing premium offshore staffing solutions to prominent businesses and SMEs. It powers clients’ internal teams with unparalleled Filipino expertise that accelerates growth and efficiency.

KDCI Outsourcing’s suite of services covers outsourced customer service, property management, graphic design, IT, content creation, and most importantly, accounting and finance. KDCI’s caliber in accounting and finance stems from its expert talent sourcing and proficient use of accounting software.

Among the outsourced accounting and finance roles it supports are payroll specialists, tax accountants, finance managers, audit associates, credit controllers, and general ledger accountants.

Communicative and tech-savvy, KDCI’s general ledger accountants are the epitome of detail-orientedness, able to detect discrepancies in a trial balance as well as leverage AI and automation to improve accuracy and uphold data integrity.

For example, instead of manually inputting journal entries, the firm’s general ledger accountants use rule-based automation to process financial data for higher productivity and quicker turnaround times.

With KDCI’s talented general ledger accountants, masterful grasp of general ledger software, and familiarity with Generally Accepted Accounting Principles (GAAP), KDCI Outsourcing stands as one of the best BPO companies and general ledger accounting firms in the Philippines.

BruntWork is a Philippine-based remote-only outsourcing company specializing in building dedicated offshore teams for businesses of all sizes. With over a thousand positive reviews averaging 4.9 stars, BruntWork has established its reputation as a leading provider of high-caliber outsourcing solutions that drive innovation, cost savings, and operational efficiency.

The company has worked with businesses from various industries, personalizing each outsourcing solution to meet unique industry and client needs for long-term success. Like KDCI Outsourcing and other BPOs, BruntWork delivers a diverse suite of outsourcing services, including virtual assistance, digital marketing, web development, and bookkeeping.

The firm’s bookkeeping services cover the following:

Known for their tech-savviness and keen eye for details, BruntWork’s team of general ledger professionals can maintain financial accuracy and work under pressure without sacrificing efficiency.

These individuals have garnered over half a decade of bookkeeping and general ledger management experience, making them a reliable asset for any client. Because they value lifelong learning, they continuously upskill and improve their proficiency in the latest general ledger software to ensure accurate financial records and avoid compliance issues.

While BruntWork (and most outsourcing companies) is great for long-term partnerships, it is also a viable option for clients looking for cost-effective, project-based general ledger management assistance.

Flatworld Solutions, or FWS, is a Davao-based BPO firm and one of the best cost accounting companies in the Philippines that excels in delivering strategic outsourcing solutions to clients worldwide. Renowned for its secure IT infrastructure, modern office spaces, and implementation of advanced software, FWS provides technology-driven BPO services that effectively blend cost-effectiveness with the evolving needs of businesses across industries.

The company offers a buffet of outsourcing solutions, spanning from data science to accounting and finance — all of which include specialized offerings. In accounting and finance, specifically, FWS delivers a wide range of niche services, including cost accounting, financial investigation and data processing, fixed asset accounting, and general ledger accounting.

The company’s accounting ledger professionals process journal entries, document adjustments, address errors in financial data, reconcile accounts, and perform decision-making. In an industry field where large volumes of financial data are processed, FWS understands the need for data privacy and security.

To give clients peace of mind, the company sets up firewalls and implements data encryption practices to ensure safe data transfers and minimize cyber threats. As proof of its commitment to security, FWS has an ISO/IEC 27001:2022 ISMS certification — a global security standard that underscores the continuous implementation and management of a company’s information security management system (ISMS).

Furthermore, the firm’s general ledger accounting services are scalable, allowing companies to grow their accounting teams as needed. With its cutting-edge general ledger accounting software, clients can expect compliant, error-free financial reporting and fast turnaround times.

Visaya KPO is a company that lives and breathes excellence, delivering unrivalled outsourcing solutions that promote long-lasting growth and strong client partnerships. As a firm that values respect and trust, clients are treated as partners who, like Visaya KPO, strive to reach the pinnacle of success and achieve fulfillment.

This outsourcing firm excels in customer service, back-office support, healthcare, and accounting across multiple industries, such as banking, e-commerce, and education. Visaya KPO’s outsourced accounting and finance solutions go beyond order fulfillment and accounts receivable and payable services; its offerings also include procurement and sourcing, mortgage loan processing, and general ledger accounting services.

By outsourcing general ledger accounting to Visaya KPO, clients can work with meticulous and highly experienced Filipino general ledger accountants who can track financial transactions, spot discrepancies, tally entries, and reconcile accounts with unparalleled efficiency using advanced general ledger accounting software — resulting in compliant and accurate financial reporting that paints a clearer picture of a business’s financial performance.

With accurate financial insights, businesses can forecast their financial health and make strategic decisions. Plus, thanks to Visaya KPO’s cost-effective general ledger accounting services, clients can reduce labor expenses, allowing them to maintain a smaller internal accounting team.

Overall, Visaya KPO is a great general ledger accounting firm for businesses that value a deeper and lasting client-service provider partnership.

Remotify PH is an Employer of Record (EOR) firm known for putting customers at the forefront of its operations. With its fervent passion for delivering client-centric services, Remotify PH does not settle for mediocrity; rather, it strives for excellence. Because people are central to its outsourcing efforts, Remotify PH also invests in its employees’ professional development through its I.N.S.P.I.R.E program.

As an EOR company, it handles the functions of a human resources department, including employee hiring and compliance. From outsourced graphic designers to general ledger accountants, Remotify PH can source and hire the most qualified professionals for a remote team.

The general ledger accountants it hires exhibit not only a strong grasp of accounting functions and knowledge of accounting compliance standards, but also keen attention to detail and exceptional problem-solving skills. This gives you the confidence to entrust your company’s accounting workflows to your remote accountants, thus allowing your internal team to focus on high-value tasks.

In conclusion, Remotify PH is a solid choice for building a remote general ledger accounting team and expanding your talent pool without increasing costs.

Formerly called Garcia De Castro & Co., Ramon F. Garcia & Company, CPAs (RFGCO) is a leading Philippine accounting firm established by the eponymous Filipino marketer and public accountant. The company has been part of Crowe Global since 2008, and its partnership with the said accounting network has paved the way for its services to cross international borders and grow its client base, serving as a driving force for RFGCO to strive for excellence.

Since its founding in 1981, RFGO continues to leverage its decades of accounting experience in delivering cutting-edge auditing, risk management, taxation, and advisory services. It also offers outsourcing services through Crowe Philippines Consultancy Inc. (CPCI) — RFGO’s dedicated outsourcing arm.

When outsourcing general ledger accounting, CPCI conducts a thorough assessment of your accounting department, from its day-to-day operations down to the technology. From there, CPCI personalizes outsourced general ledger accounting solutions to fit your needs. These solutions also extend to streamlining general ledger accounting through the provision of accounting technologies.

With CPCI’s talented general ledger accountants, you can ensure that all accounting books are accurate and compliant, thus helping you make key business decisions. Because CPCI aims for excellence and client satisfaction, customers can expect to receive world-class, value-driven outsourcing solutions.

FilWeb Asia, Inc.’s Outsource Philippines is a forward-thinking BPO company with a heart for building client relationships grounded in its core values of respect, trust, accountability, and discipline. From the healthcare to the retail industry, Outsource Philippines offers a diverse range of services such as outsourced web design, grant writing, telemarketing, and accounting and bookkeeping.

Designed to eliminate inefficiencies and financial liabilities, the firm’s outsourced accounting and bookkeeping services help companies ensure general ledger account accuracy and compliance with GAAP. Outsource Philippines’ accountants routinely maintain and update your general ledger system, documenting and reconciling each general ledger entry as needed to prepare tallied, audit-ready financial statements.

By working with Outsource Philippines, you can enjoy top-tier data privacy thanks to its robust data security infrastructure and non-disclosure agreements (NDA). Moreover, it offers three pricing models: production-based, cost-based, and fixed project. Depending on your general ledger accounting needs, Outsource Philippines can help you choose the most appropriate pricing model for your budget.

Overall, Outsource Philippines stands out as an exceptional outsourcing provider — offering not only efficiency, customer-centric, and reliable general ledger accounting solutions, but also a collaborative outsourcing experience that brings out your company’s best.

A general ledger should not be a forgotten piece of your accounting puzzle. Whether your company is struggling with meeting compliance standards or reconciling a ledger account, KDCI Outsourcing is more than capable of handling your business’s general ledger accounting.

We employ professional general ledger accountants who are well-versed in GAAP and capable of handling large volumes of financial data with care and precision. By building your own remote general ledger accounting team with KDCI Outsourcing, your company benefits not only from the expertise of our team members, but also their warmth, hospitality, and dedication — Filipino traits our clients admire the most.

Innovation and compliance don’t wait. Level up your general ledger accounting with KDCI Outsourcing today. Head on to our Contact Us page and shoot us a quick inquiry or proposal.