.png)

.png)

.png)

.png)

Managing accounts payable might not be the most glamorous part of running a business, but it’s one of the most critical. From invoice processing to approval workflows and reconciliation, the payable process demands accuracy, consistency, and lots of time. For growing companies, scaling a business in the US by partnering with Philippine accounts payable providers has become a smart, strategic move.

Why? Because payable outsourcing does more than just trim costs. It improves cash flow, strengthens vendor relationships, and introduces scalable payment solutions that are hard to maintain in-house. With the right provider, your accounts payable outsourcing strategy becomes a growth lever, not just an operational fix.

Let’s dive into the top 10 payable services providers in the Philippines trusted by US companies and why they could be the key to modernizing your finance operations.

The Philippines has long been a global leader in financial services outsourcing. The country combines deep accounting talent, strong English fluency, and a cultural alignment with Western business practices. For AP specifically, the value is even clearer:

What sets a Philippine accounts payable provider apart is their ability to act as a seamless extension of your finance team handling day-to-day tasks while helping you scale smarter.

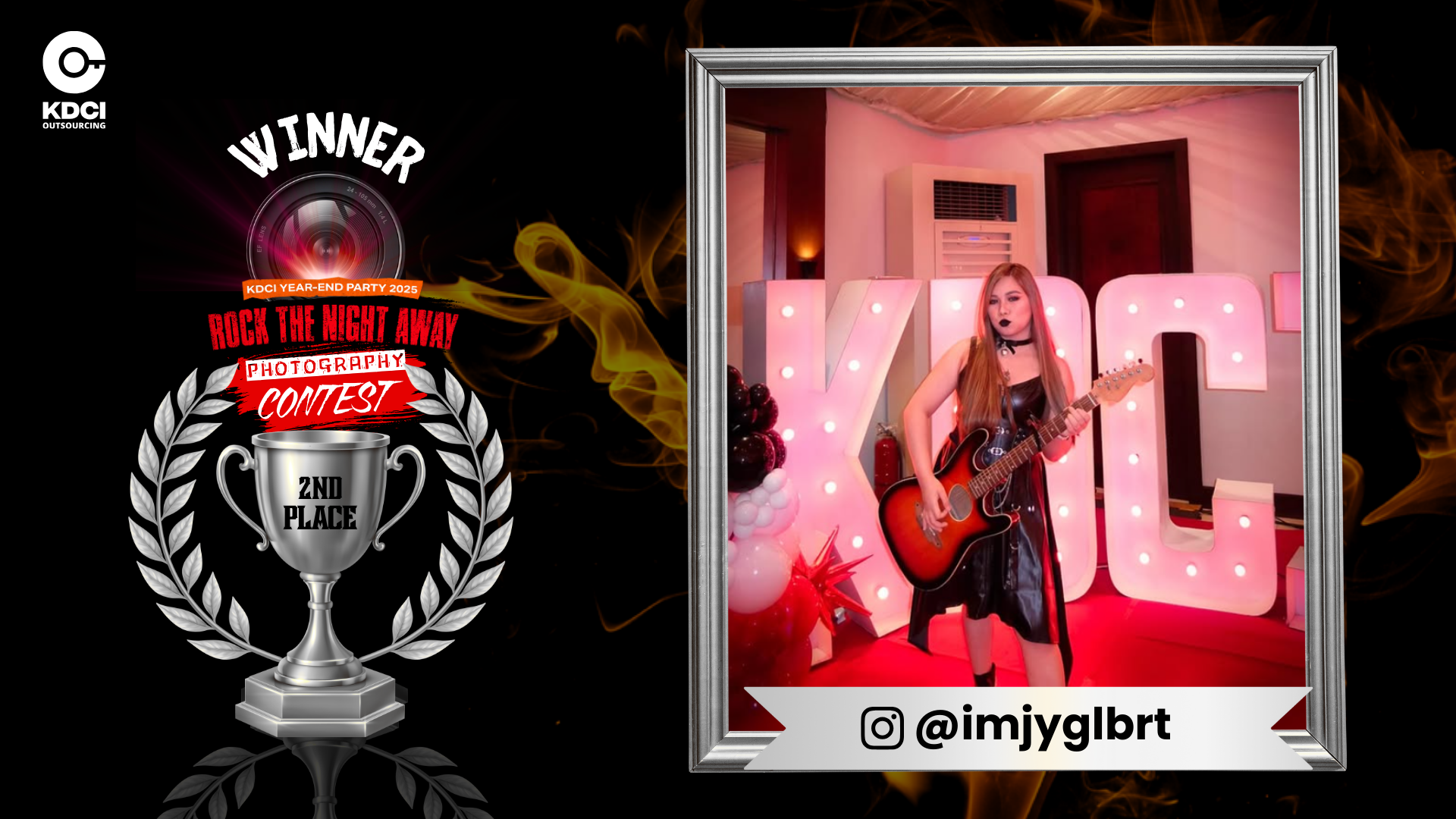

KDCI is one of the most trusted names in accounts payable outsourcing for US-based businesses. With over a decade of experience, they offer dedicated teams that manage everything from invoice capture to approvals and vendor communication.

They specialize in integrating with your existing payable software, ensuring a smooth and transparent payable process. Clients also benefit from bundled bookkeeping services, FP&A support, and other accounting services.

Why choose KDCI?

Excellent customer service and hands-on onboarding support

Cloudstaff builds custom finance teams for companies needing flexibility in both hours and workload. Their AP specialists are trained to manage end-to-end payable services using your tools and workflows.

They support multiple US time zones and maintain a strong record of boosting cashflow efficiency through faster approvals and automated exception handling. Their clear handling of payment terms ensures vendors are paid on time and relationships remain strong.

Ideal for CPA firms and finance teams that want industry-aligned professionals, TOA Global focuses exclusively on accounting and financial services. Their AP staff are trained in US GAAP and compliance requirements, making them a top choice for firms that want more than just processing, they want advisory-level thinking.

They also provide complete bookkeeping services, allowing clients to centralize their finance operations and ensure accurate financial records for each reporting cycle.

Staff Domain helps US companies build high-performing remote teams with strong oversight. Their AP specialists handle invoice entry, approvals, payment terms, vendor follow-up, and reconciliation.

One of their strengths is helping clients evolve through payable automation, identifying bottlenecks and integrating smarter workflows to improve cashflow and reduce human error.

Hammerjack merges human expertise with smart automation. They specialize in using RPA and OCR tools to streamline the AP function, minimizing manual entry and boosting throughput.

Clients love how their payable automation platform speeds up the entire payable process, giving finance leaders more time to focus on forecasting, reviewing financial records, and managing vendor relationships effectively.

Emapta lets companies fully customize their offshore team from hiring to training and system setup. They offer flexible payment solutions that align with your company's unique structure and payment terms.

Whether you're looking for full-service accounts payable outsourcing or to support your in-house staff during peak periods, Emapta provides the scalability and control to grow with confidence.

Diversify works with enterprise and mid-sized businesses that demand high-compliance environments. Their secure, ISO-certified offices and experienced teams make them a go-to for companies in regulated industries.

Their AP services extend beyond data entry, offering full payable management support, including compliance monitoring, accurate financial records, and metrics tracking to boost cash flow predictability. Their customer service approach includes dedicated account managers for consistent support.

A leader in BPO, MicroSourcing offers AP teams that handle high-volume invoice processing, vendor payments, and reconciliation. They’ve supported businesses across retail, logistics, healthcare, and more.

Their end-to-end payable outsourcing includes access to reporting tools that help CFOs maintain visibility, ensure compliance with payment terms, and monitor the health of their financial records.

Ascend Asia is known for personalized service. They work closely with startups and SMEs to build AP teams that feel like an extension of your core staff.

They bring deep experience in bookkeeping services and accounting services, along with consistent communication and easy onboarding. Their clients appreciate the responsive customer service and SOP customization that ensures a clean, consistent payable process.

Perfect for businesses new to outsourcing, iSupport provides AP support with white-glove onboarding and US-based account managers.

They focus on helping clients transition their payable process smoothly, with a strong emphasis on compliance, accurate financial records, and measurable impact on cash flow. Their teams follow strict payment terms guidelines to support healthy vendor relationships.

Choosing to outsource AP isn’t just about cutting costs ,it’s about creating space for growth. When a Philippine accounts payable provider takes over time-consuming tasks, your internal team gains the freedom to focus on financial planning, business development, and strategy. So try to outsource administrative support for your company.

With the right payable services team, you can:

Partnering with the right Philippine accounts payable provider helps your business scale with less stress. From automating the payable process to outsourcing human resource solutions, managing vendor outreach, and delivering reliable payment solutions, these outsourcing partners allow you to focus on the future without sacrificing accuracy, transparency, or service quality

Whether you're a startup trying to stay lean or an established company looking to optimize operations, these top 10 providers bring the tools, talent, and professionalism to elevate your accounts payable outsourcing strategy.

Need better cash flow, cleaner financial records, and world-class customer service? Try to outsource accounting to the Philippines. Start a conversation with one of these providers today and transform your payables into a strategic advantage.

Looking for a trusted Philippine accounts payable provider? Outsource your accounting and finance to take the stress out of your day-to-day operations. KDCI Outsourcing offers end-to-end payable services designed to improve accuracy, boost cashflow, and strengthen vendor relationships, all while giving you more time to focus on growth.

Our experienced AP specialists integrate directly into your workflows and systems, delivering reliable support across the full payable process, from invoice entry and approvals to reconciliation and reporting. With a deep understanding of US payment terms, GAAP standards, and leading payable software, our team ensures your business stays compliant, consistent, and in control.

Ready to simplify your accounts payable outsourcing strategy? Get in touch with us today and see how KDCI can help you build a high-performing offshore AP team tailored to your needs.